Analyzing the Rise and Fall of Ventyx’s Primary Candidate

Ventyx is a clinical-stage immunology biotech company with candidates for Crohn's disease, ulcerative colitis, and cardiovascular disease. In March 2023, Ventyx boasted a market capitalization exceeding 2.4 billion dollars. Today, that figure has dwindled to a mere 140 million dollars, with 308 million dollars in reserves. The past six months have been challenging for Ventyx, starting with disappointing data on their secondary candidate ulcerative colitis therapeutic and culminating on November 7th, 2023 when their stock plummeted by 72%. This second drastic decline in market value was initiated by the presentation of the phase II data for their primary candidate VTX958 in plaque psoriasis. At first glance, the data seemed promising, achieving statistical significance in both primary and secondary endpoints. Despite this, they opted to discontinue the therapy in two out of three indications – plaque psoriasis and psoriatic arthritis – citing a lack of commercial viability, particularly in comparison to BMS’ Sotyktu, which received approval for plaque psoriasis in September 2023.

Interestingly, Ventyx’s management has persisted with VTX958 in clinical trials for Crohn's disease. Does this present an opportunity for a significant value play? Can VXT958 succeed in Crohn's where it faltered in plaque psoriasis and psoriatic arthritis?

The Rise of VTX958

To answer this, let’s revisit what initially fueled the high valuation of VTX958. VTX958 is an oral TYK2 inhibitor, a strategic choice leveraging a known mechanism of action against a known target. TYK2 was selected for its specificity compared to inhibiting JAK. Inhibitors of JAK are often not selective to a specific kinase. Rather, they bind to the whole JAK family, potentially mitigating the toxicities associated with JAK inhibitors. VTX958’s preclinical data included a head-to-head comparison with BMS’ Sotyktu, another TYK2 inhibitor farther ahead in the pipeline.

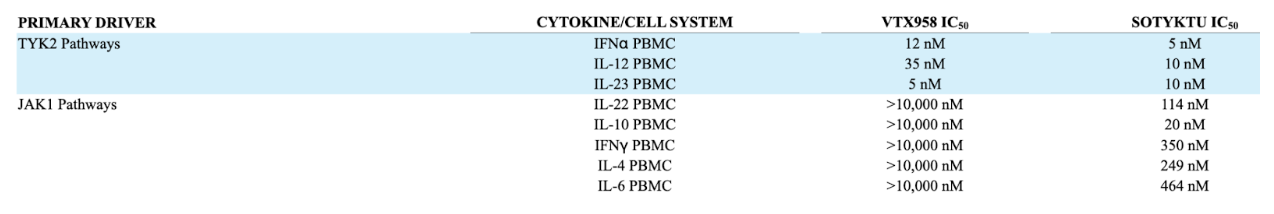

(Ventyx 2023 10-K)

Above is an IC50 table that displays the concentration of VTX958 vs. Sotyktu necessary to inhibit 50% of the multiple inflammatory cytokine activities in peripheral blood mononuclear cells (PBMCs). VTX958 maintained a more selective profile to TYK2 compared to Sotyktu, potentially leading to a larger therapeutic window and enabling higher and safer doses by minimizing the risk of off-target effects and maximizing the therapeutic benefits. However, critiques have emerged post hoc, questioning whether or not their candidate is too selective and would not lead to a large enough biological effect.

(Ventyx 2023 10-K)

Additionally, Ventyx reported strong interim phase I data, with VTX958 being well tolerated and exhibiting a dose-dependent response (see graph above). There were no serious adverse events or discontinuations due to adverse events across all cohorts in the single-ascending dose and multiple-ascending dose studies. Thus, through decent preclinical and phase I safety data, Ventyx rode the wave of success until it was time to release its phase II efficacy data.

The Fall of VTX958

The data, unveiled on November 7th, 2023, showcased promising results for VTX958 at week 16 through a PASI endpoint. PASI stands for Psoriasis Area and Severity Index, and PASI 75 means that the patient reached 75% or greater improvement in PASI from baseline. The graph below demonstrates the PASI 75, PASI 90, and PASI 100 scores, with the y-axis being the percent of the 43 patients that reached such criteria. Nearly 50% of patients achieved PASI 75, with 42% reaching PASI 90, indicating a clinically meaningful effect.

(Ventyx Company Presentation – VTX958 Phase 2 Plaque Psoriasis Results)

(Sotyktu FDA Open Label)

While these results typically warrant proceeding to a larger phase III trial, they closely mirrored Sotyktu’s data. For instance, Sotyktu achieved PASI 75 in 53% of patients at week 16. And while VTX958 demonstrated a stronger efficacy in PASI 90, the significance of this difference remains uncertain, especially given disease variability and trial size. Consequently, the probability of physicians switching from Sotyktu after prescribing it for over two years is low, which significantly reduces the evidence in favor of a larger clinical trial. As a result, this justifies the management decision to abandon plaque psoriasis and psoriatic arthritis as candidate indications.

VTX958’s Future in Crohn’s Disease

Nevertheless, it is very interesting to hear of Ventyx's decision to persevere with Crohn's disease. To evaluate the viability of this decision, we must assess the unmet need, market size, standard of care, and the proposed efficacy of VTX958 in this indication.

Crohn’s disease, a subtype of inflammatory bowel disease (IBD), induces inflammation and irritation in the digestive tract, leading to symptoms like abdominal pain, diarrhea, weight loss, and rectal bleeding. Its onset and manifestation are highly variable, often accompanied by painful symptoms such as abscesses, anal fissures, fistulas, and bowel obstructions. Presently, treatments focus on symptom management rather than a cure, reflecting a substantial unmet need.

There are 750,000 people with Crohn’s disease in the US and 6-8 million cases globally.

The disease's considerable size and unmet needs are evident. Although not typically fatal, Crohn’s significantly reduces life expectancy and quality of life due to unpredictable flare-ups and debilitating symptoms.

Standard of Care for Crohn’s Disease

The standard of care includes drugs like Remicade (Infliximab) and Rinvoq (upadacitinib), which induce remission and alleviate symptoms. Remicade, an intravenously delivered drug approved in 1998, inhibits tumor necrosis factor-alpha and is used to treat Crohn's disease as well as several other inflammatory indications. Across its indications, it brought in 2.5B in revenue in 2022 for J&J, and while this revenue statistic has decreased year on year (5.3B in 2019), it still remains the standard of care for many physicians. Rinvoq was recently approved in 2023 for Crohn’s and has been approved since 2019 for other indications as an oral competitor targeting JAK 1 and 2. In the fourth quarter of 2023, it brought 1.3B for AbbVie. As we will discuss, its efficacy is not as good. However, its oral delivery means patient administration is significantly easier. While both are currently standard of care and show efficacy, there is clear room for improvement, as patients must still manage their lifestyles and endure painful flares.

Remicade showed positive clinical responses in 81% of patients after a single dose, compared to 16% for placebo. A positive response is defined as a decrease from baseline in the Pediatric Crohn's Disease Activity Index (PCDAI) score of 15 points and a total score of less than 30 points. Additionally, after eight weeks of multi-dosing, 34% of patients achieved clinical remission (Defined as a PCDAI score of less than 10 points) versus 11% with placebo (p < 0.005). Additionally, MRI results from a year-long clinical trial revealed 52% of patients had closed fistulas versus 13% with a placebo. (Remicade FDA Open Label)

Rinvoq demonstrated substantial efficacy, with 36% clinical remission at week 12 and a staggering 55% at week 52 (Crohn’s Disease Activity Index (CDAI) < 150). It is important to note that both PCDAI (the standard Remicade uses) and CDAI (the standard Rinvoq uses) are respected in the industry and differ only based on patient selection. Although Rinvoq's one-year data appears impressive compared to Remicade’s eight-week dosing regimen, it's crucial to consider the difference in dosing duration. Rinvoq's continuous dosing over the entire year may contribute to its favorable outcomes. However, it's reasonable to speculate that if Remicade were dosed for the same duration, its results might be similarly favorable, if not more so. Nevertheless, Rinvoq is a small molecule offering advantages in easier therapeutic administration as an oral and can be taken in an outpatient setting. (Rinvoq FDA Open Label)

Based on these two standards of care, it appears that the bar is high, yet there remains substantial room for improvement. Patients must still be vigilant about their lifestyle choices and endure painful disease flare-ups.

Synthetic Data Analysis for Crohn’s Disease Harnessing Ulcerative Colitis

Now that we know there is room to improve against the standard of care, it is crucial to explore the potential effectiveness of VTX958 in Crohn's disease. Notably, the current standard treatments for Crohn's disease are also approved for ulcerative colitis (UC).

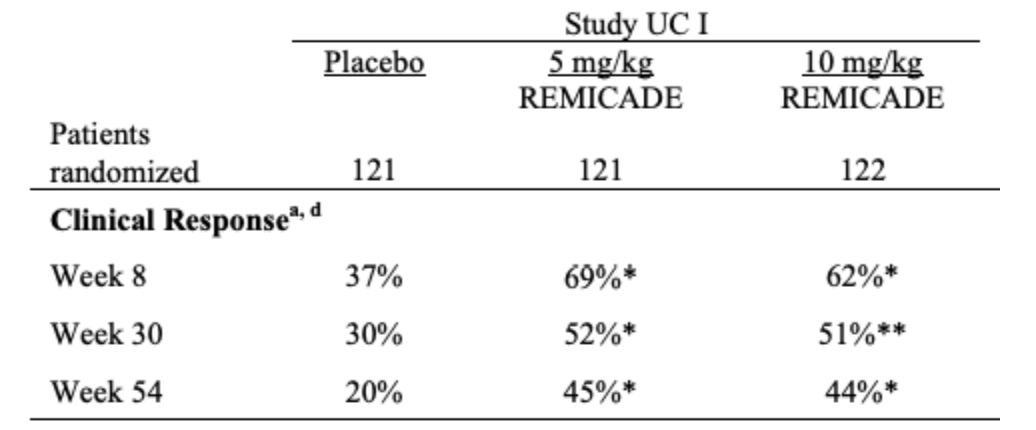

Remicade, which has shown promising results in Crohn’s disease, also exhibits strong performance in UC at both 30 and 54 weeks, achieving a clinical response of 51% and 44%, respectively. Clinical response is defined as a decrease from baseline in the Mayo score by 30% and a decrease in the rectal bleeding subscore to 1 or 0 (Remicade FDA Open Label). It's important to recognize that a clinical response, while significant, does not equate to clinical remission, highlighting the severe impact of UC.

(Remicade FDA Open Label)

Similarly, Rinvoq demonstrated a 26% clinical remission at 8 weeks, increasing to 52% after a year of maintenance. Clinical remission is defined as stool frequency sub-score (SFS) ≤1 and not greater than baseline. Although the results at week 8 were less pronounced, it's critical to note that the study focused on clinical remission, as opposed to Remicade's data on clinical response, which is a lower bar. (Rinvoq FDA Open Label)

Considering the similarities between Crohn's and UC, it begs the question of whether oral TYK2 inhibitors could be compared to the existing standards of care. Unfortunately, a clinical trial in UC conducted by BMS with Sotyktu failed, where the drug performed worse than a placebo, achieving only a 14.8% clinical remission compared to 16.3% with the placebo. (ClinicalTrials.gov – NCT03934216).

Given the similarities between Sotyktu and VTX958, including molecular target, pharmacokinetics/ pharmacodynamics, and efficacy data in plaque psoriasis, it's logical to infer that its performance in UC and Crohn's might mirror these outcomes. Consequently, this suggests that VTX958 may not succeed in treating Crohn's disease.

VTX958 Outlook

If this is the case, and Ventyx management knows this, then why proceed with Crohn’s disease instead of cutting losses and redirecting funds used for the trial to other clinical candidates? While I have not met with management, nor have they discussed their decision in much depth, I listened to their presentation at the Barclays 26th Annual Global Healthcare Conference, and, for the good reason of their stock crumbling over the past six months, they seem pretty depressed and unmotivated to move forward. It seems that they are just waiting for the data to cancel the Crohn’s data, but they want to play it out to see if there is a sliver of chance to gain momentum once again.

In summary, this analysis allows us to confidently predict the potential failure of VTX958 in Crohn's disease. The primary lesson is that comparing multiple drugs across various conditions enables us to make informed assumptions about their success or failure. In the future, I aim to leverage this approach to gain a deeper understanding of drug efficacy, with the hope that such insights will help predict their success more accurately.

https://ir.ventyxbio.com/static-files/f48fa8b3-d1fa-41a5-9e55-f4ce730c3d32

https://www.accessdata.fda.gov/drugsatfda_docs/label/2022/214958s000lbl.pdf

https://medlineplus.gov/genetics/condition/crohns-disease/

https://my.clevelandclinic.org/health/diseases/9357-crohns-disease

https://www.globaldata.com/data-insights/healthcare/the-global-drug-sales-of-remicade-1127451

https://www.accessdata.fda.gov/drugsatfda_docs/label/2013/103772s5359lbl.pdf